Dow theory introduced by Charles. H. Dow (1851 – 1902) along with Edward Jones. Together they published wall street journal. Dow Jones industrial average were first formulated by them and is till date the most popular index in stock market. Dow theory gives us information about the trend of the market. Below I will explain in detail about the six tenants of Dow theory.

Six basic tenets of Dow Theory :

1. Market discounts everything-

While people believe that market is subject to change on news flow, Dow theory in principal believes that market has a tendency to discount a news at the earliest. Once news is out a stock gives knee-jerk reaction to it but but soon follows the main trend and stock price reflects all available information.

2. Market is comprised of three trends-

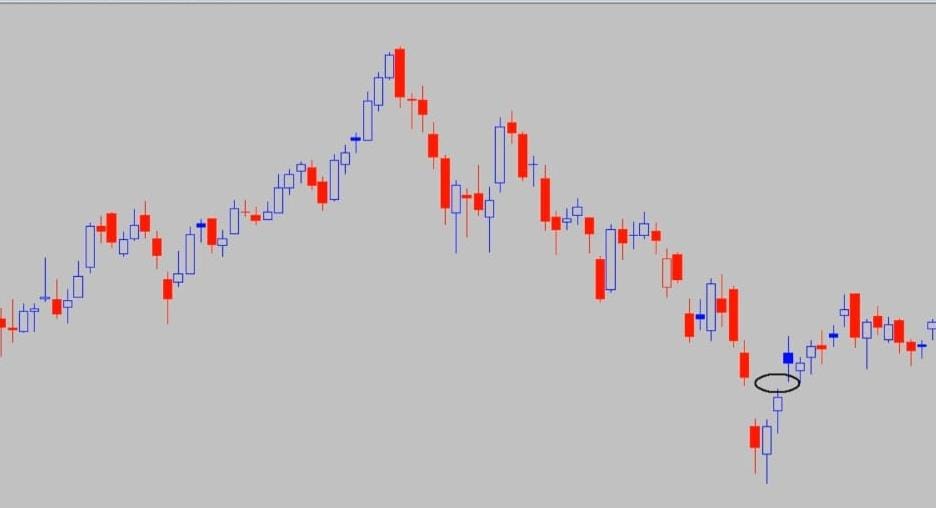

According to the theory, a market has three trends in terms of duration – Primary, Intermediate and Short-term.

The duration of Primary trend last for a year and can stretch to several years. In between the Primary trend, we have intermediate term trend. The Intermediate term trend typically lasts from three weeks to three months and is a part of Primary trend. Correction during Intermediate term trend is in opposite direction to Primary trend and the retracement can be 33 to 66 percent of previous move. There are instances when correction is time wise and not price wise. The short term trend can be as short as a tick or can prolong to seven to ten trading sessions. Short term trend typically occur within an Intermediate term trend.

The three trends may or may not be in synch with each other. The best result a trader achieved when they are in synch.

3. Primary trend has three phases –

These phases are Accumulation, Public participation and Distribution.

Accumulation is change of stock ownership at a gradual rate from weak hands to strong hands. After Accumulation, Public participation occurs chasing lesser number of stocks resulting in higher price. Distribution is change of ownership at a gradual rate from strong hands to weak hands. Normally Accumulation happens at lower prices and Distribution at higher prices.

4. The averages must confirm each other –

Two averages were formulated by Dow and Jones :

(a) Dow Jones Industrial Average

(b) Dow Jones Transportation Average

According to the theory, both the averages must perform simultaneously. This leads us to study of sector dependency or sector rotation.

5. The volume confirms the trend –

In a major uptrend the volume is generally higher on short term up trend than down trend. Similarly, in major down trend, the short term down trend have higher volume than up trend. If many participants are active in a particular security, the price moves significantly in one direction. The beginning of volume pickup is a signal that trend is developing.

6. A trend remains intact until it gives a definite reversal signal –

In spite of market noise which results in short term swings, there is always a definite trend in the market. A trader should not assume it to be over till price proves otherwise. The benefit of doubt always be with the trend under consideration.

Conclusion :

As we know , to become profitable in the stock market, it is most important to understand the trend and the Dow theory explains the trend completely. It helps a long term investor in taking investment decision as much as it helps a short term trader in taking a good trade. Although there may be many external factors where this theory cannot be completely relied upon, but despite this, Dow theory helps us the most in understanding the stock market.